All Categories

Featured

Table of Contents

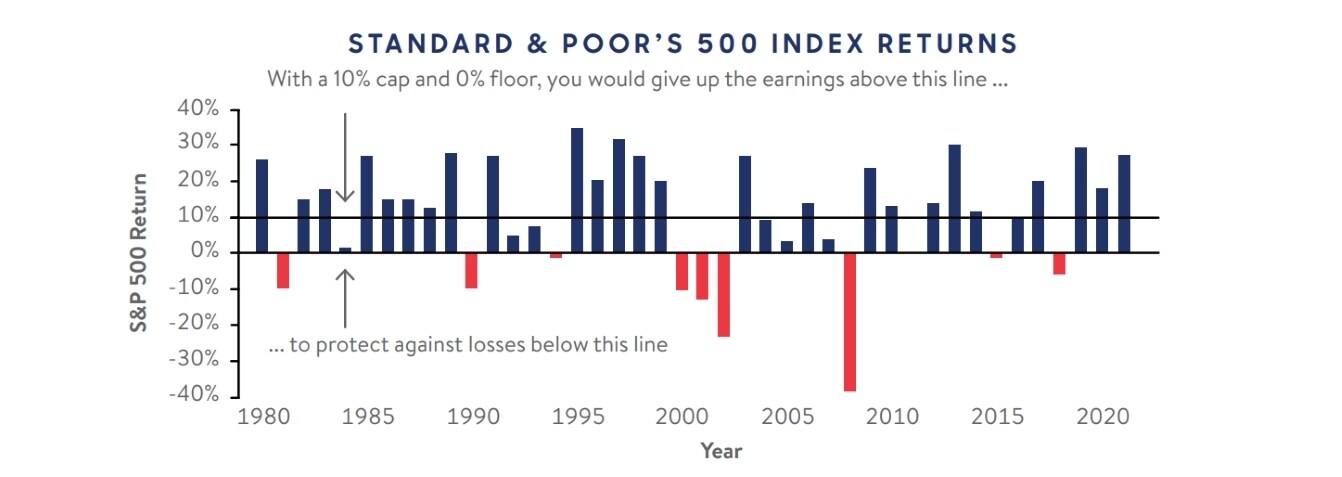

IUL contracts secure against losses while using some equity risk premium. Individual retirement accounts and 401(k)s do not offer the very same disadvantage security, though there is no cap on returns. IULs tend to have have complicated terms and greater costs. High-net-worth individuals seeking to decrease their tax obligation problem for retired life may gain from investing in an IUL.Some investors are far better off getting term insurance policy while maximizing their retirement contributions, as opposed to acquiring IULs.

If the underlying supply market index rises in a given year, proprietors will see their account increase by a symmetrical amount. Life insurance policy companies use a formula for identifying how much to credit your cash balance. While that formula is tied to the performance of an index, the amount of the credit report is nearly constantly mosting likely to be much less.

Companies typically give matching contributions to 401(k)s as an advantage. With an indexed universal life plan, there is a cap on the quantity of gains, which can restrict your account's development. These caps have yearly top limitations on account credit histories. So if an index like the S&P 500 rises 12%, your gain could be a fraction of that amount.

Iul Colony Counter

If you fall right into this category, take into consideration chatting to a fee-only monetary consultant to discuss whether purchasing irreversible insurance policy fits your total approach. For several capitalists, however, it might be much better to max out on contributions to tax-advantaged retirement accounts, especially if there are contribution matches from an employer.

Some plans have actually an assured price of return. One of the key features of indexed universal life (IUL) is that it supplies a tax-free circulations. So it can be a helpful device for investors who desire alternatives for a tax-free retirement. Usually, monetary experts would advise contribu6ting to a 401(k) prior to an individual retirement account especially if your employer is providing matching contributions.

Property and tax obligation diversification within a profile is raised. Select from these products:: Supplies lasting development and revenue. Perfect for ages 35-55.: Offers versatile coverage with modest cash money worth in years 15-30. Perfect for ages 35-65. Some things clients must consider: For the survivor benefit, life insurance policy products bill fees such as mortality and expenditure risk costs and abandonment charges.

Retired life preparation is important to maintaining economic security and keeping a specific standard of life. of all Americans are fretted concerning "maintaining a comfortable standard of life in retirement," according to a 2012 survey by Americans for Secure Retired Life. Based on current data, this majority of Americans are warranted in their issue.

Department of Labor estimates that a person will require to maintain their existing standard of living as soon as they begin retirement. In addition, one-third of U.S. house owners, in between the ages of 30 and 59, will not have the ability to preserve their criterion of living after retired life, even if they delay their retired life till age 70, according to a 2012 study by the Staff member Advantage Study Institute.

Iul Or Roth Ira: Which Is Right For Your Financial Future?

In 2010 greater than 80 percent of those in between age 50 and 61 held financial debt, according to the Social Safety And Security Management (SSA). The average financial debt quantity among this age team was greater than $150,000. In the same year those aged 75 and older held a typical financial obligation of $27,409. Alarmingly, that number had even more than doubled since 2007 when the average financial debt was $13,665, according to the Fringe benefit Study Institute (EBRI).

56 percent of American senior citizens still had exceptional financial obligations when they retired in 2012, according to a study by CESI Financial debt Solutions. The Roth IRA and Policy are both tools that can be utilized to build substantial retired life savings.

These monetary tools are comparable in that they benefit insurance policy holders who wish to create cost savings at a reduced tax rate than they might experience in the future. Make each more eye-catching for individuals with differing requirements. Determining which is much better for you relies on your personal scenario. In either case, the policy expands based upon the interest, or dividends, attributed to the account.

That makes Roth IRAs perfect financial savings cars for young, lower-income workers that reside in a lower tax obligation brace and who will benefit from decades of tax-free, compounded growth. Given that there are no minimum required contributions, a Roth individual retirement account provides investors control over their personal goals and run the risk of resistance. Additionally, there are no minimum needed circulations at any age throughout the life of the plan.

To compare ULI and 401K strategies, take a moment to comprehend the basics of both items: A 401(k) lets workers make tax-deductible payments and delight in tax-deferred development. When workers retire, they normally pay tax obligations on withdrawals as ordinary earnings.

Indexed Universal Life Insurance Vs Retirement Accounts

Like other irreversible life plans, a ULI plan additionally allocates part of the costs to a cash account. Since these are fixed-index plans, unlike variable life, the plan will certainly likewise have actually a guaranteed minimum, so the money in the cash account will certainly not decrease if the index decreases.

Policy owners will certainly also tax-deferred gains within their money account. iul com. Discover some highlights of the benefits that global life insurance policy can provide: Universal life insurance coverage plans don't impose limits on the dimension of policies, so they may give a way for employees to conserve even more if they have actually currently maxed out the Internal revenue service limits for other tax-advantaged monetary items.

The IUL is far better than a 401(k) or an IRA when it comes to conserving for retirement. With his nearly half a century of experience as an economic strategist and retired life planning expert, Doug Andrew can show you specifically why this holds true. Not just will Doug discusses why an Indexed Universal Life insurance coverage contract is the far better car, but likewise you can also learn exactly how to optimize assets, decrease tax obligations and to equip your genuine wide range on Doug's 3 Dimensional Riches YouTube network. Why is tax-deferred accumulation much less preferable than tax-free build-up? Find out just how procrastinating those taxes to a future time is taking an awful danger with your cost savings.

Latest Posts

Indexed Universal Life Insurance Vs Whole Life Insurance

What Is The Difference Between Term And Universal Life Insurance

Ul Mutual Life Insurance